nebraska sales tax percentage

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. The minimum combined 2022 sales tax rate for Nemaha Nebraska is.

General Fund Receipts Nebraska Department Of Revenue

The Total Rate column has an for those municipalities.

. For tax rates in other cities see Nebraska sales taxes by city and county. What is the sales tax rate in Nemaha Nebraska. Fractions of a cent should be rounded to the nearest cent.

You can print a 65 sales tax table here. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Nebraska levies a property tax on all real and personal property within the state.

For vehicles that are being rented or leased see see taxation of leases and rentals. Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each impose a tax rate of 05. 1991 2009 110.

Local Sales and Use Tax Rates Effective January 1 2021 Dakota County and Gage County each impose a tax rate of 05. There are approximately 812 people living in the Cortland area. There are a total of 334 local tax jurisdictions across the state collecting an average local tax of 0825.

The 65 sales tax rate in Hyannis consists of 55 Nebraska state sales tax and 1 Hyannis tax. For tax rates in other cities see. The Nemaha sales tax rate is.

Nebraska Department of Revenue. The County sales tax rate is. You can find these fees further down on the page.

See the County Sales and Use Tax Rates section at the end of this listing for information on how these counties are treated differently. 2 lower than the maximum sales tax in NE. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75.

The Ord Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Ord local sales taxesThe local sales tax consists of a 150 city sales tax. There are approximately 704 people living in the Dannebrog area. An alternative sales tax rate of 65 applies in the tax region Dannebrog which appertains to zip code 68831.

31 rows The state sales tax rate in Nebraska is 5500. Nebraska has 149 special sales tax jurisdictions with local sales taxes in addition to the state. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor vehicle sales tax collections are compiled from county and city information that is selfreported by applicants when requesting a sales tax permit.

Average Sales Tax With Local. You can print a 55 sales tax table here. This is the total of state county and city sales tax rates.

The Dannebrog Nebraska sales tax rate of 55 applies in the zip code 68831. 7 Nebraska Sales and Use Tax Rate Schedule For sales in excess of those covered by this schedule the tax may be computed by multiplying the sale by 07. Remember that zip code boundaries dont always match up with political boundaries.

The 7 sales tax rate in Stuart consists of 55 Nebraska state sales tax and 15 Stuart tax. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. You can print a 7 sales tax table here.

The use tax rate is the same as the sales tax rate. The Total Rate column has an for those municipalities. The 55 sales tax rate in Nemaha consists of 55 Nebraska state sales tax.

1565 1578 110. With local taxes the. Fractions of a cent should be rounded to the nearest cent.

Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. Interactive Tax Map Unlimited Use. Nebraska Sales Tax Rate Finder.

Groceries are exempt from the Nebraska sales tax. Ord collects a 15 local sales tax the maximum local. See the County Sales and Use Tax Rates section at the end of this listing for information on how these counties are treated differently.

The current sales tax rate in Nebraska is 55. Businesses that make taxable purchases for resale manufacture or processing must pay a use tax instead of sales tax. An alternative sales tax rate of 55 applies in the tax region Jefferson which appertains to zip code 68429.

The Nebraska NE state sales tax rate is currently 55. And when that fraction is an even one-half the amount should be rounded to the next higher whole cent. The Nebraska sales tax rate is currently.

The Ord Sales Tax is collected by the merchant on all qualifying sales made within Ord. The state sales tax rate in Nebraska is 55 but you can customize this table as needed. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

For example lets say that you want to purchase a new car for 60000 you would use the following formula to calculate the sales tax. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Wayfair Inc affect Nebraska.

For tax rates in other cities see Nebraska sales taxes by city and county. The Cortland Nebraska sales tax rate of 6 applies in the zip code 68331. 55 Nebraska Sales and Use Tax Rate Schedule For sales in excess of those covered by this schedule the tax may be computed by multiplying the sale by 055.

Groceries are exempt from the Ord and Nebraska state sales taxes. Nebraska sales tax details. Sales Tax 60000 - 5000.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. There is no applicable county tax city tax or special tax. Did South Dakota v.

You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected.

There is no applicable county tax or special tax. And when that fraction is an even one-half the amount should be rounded to the next higher whole cent. An alternative sales tax rate of 7 applies in the tax region Cortland which appertains to zip code 68331.

Ad Lookup Sales Tax Rates For Free. The Reynolds Nebraska sales tax rate of 55 applies in the zip code 68429. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

The Nebraska State Sales Tax is collected by the merchant on all qualifying sales made within. The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. There is no applicable county tax or special tax.

The Nebraska state sales and use tax rate is 55 055.

Historical Nebraska Tax Policy Information Ballotpedia

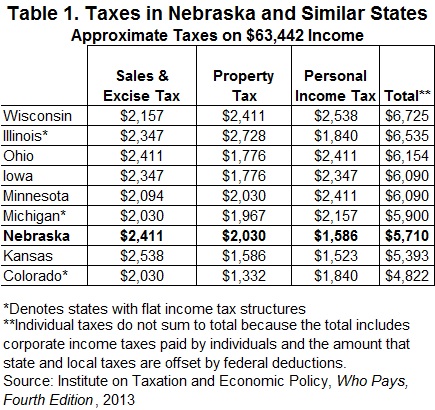

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Nebraska Taxes At A Glance Open Sky Policy Institute

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

Nebraska Sales Tax Small Business Guide Truic

Wfr Nebraska State Fixes 2022 Resourcing Edge

Taxes And Spending In Nebraska

Nebraska Income Tax Ne State Tax Calculator Community Tax

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

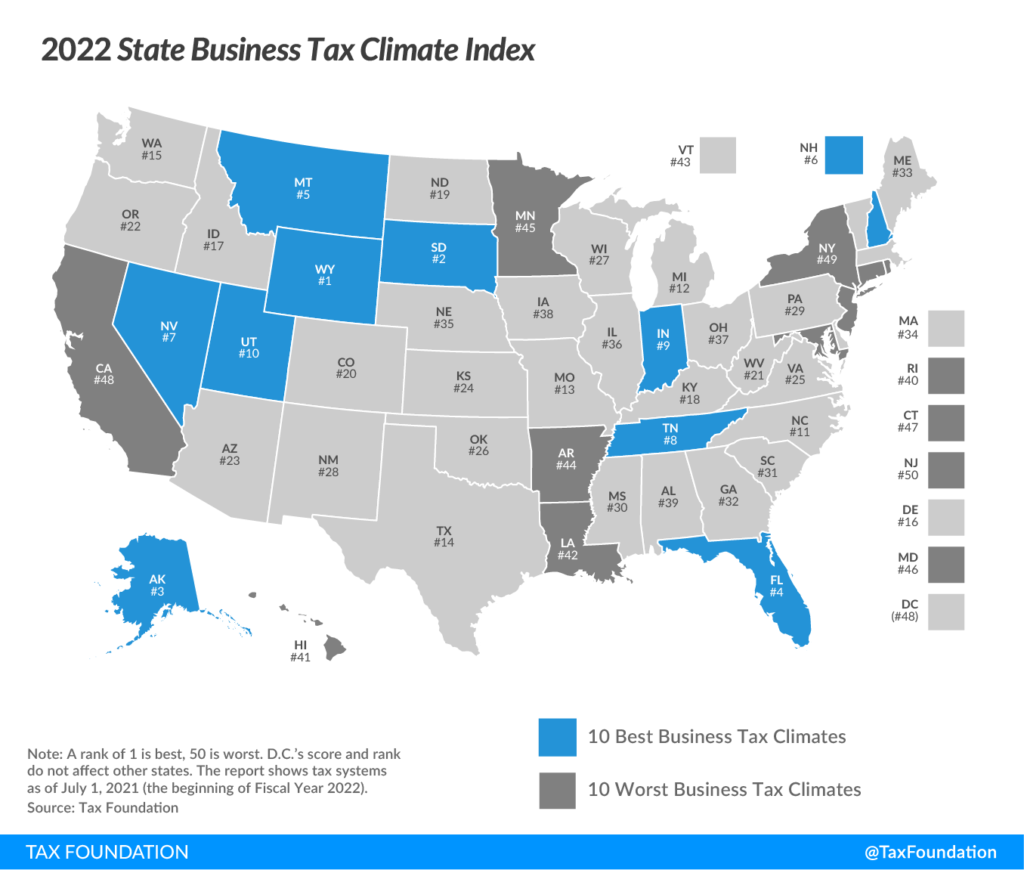

Nebraska Drops To 35th In National Tax Ranking

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Proposed Bill Would Add New Income Tax Bracket In Nebraska Kptm